The following was forwarded to me by Bayi and I wish I could do something to the pictures, like using the same house with necessary 'make-overs' to reflect the intended messages. Anyway, this will do, with my comments in italics...

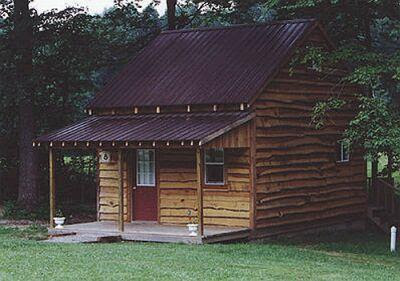

Your buyer...

(This is probably the view when the prospective buyer is trying to haggle on the price with the seller. I am sure he would have found it attractive initially to be interested.)

(This is probably the view when the prospective buyer is trying to haggle on the price with the seller. I am sure he would have found it attractive initially to be interested.)

(This is probably the view when the prospective buyer is trying to haggle on the price with the seller. I am sure he would have found it attractive initially to be interested.)

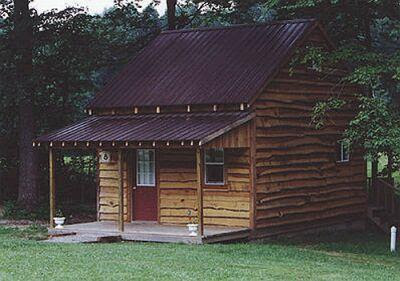

(This is probably the view when the prospective buyer is trying to haggle on the price with the seller. I am sure he would have found it attractive initially to be interested.)Your lender...

(Ah, this reminds me of when my wife first bought the house for rebuilding. It was a run-down wooden house, but the bank manager was so eager to sort out the outstanding loan (non-performing, I guess) that he offered a decent housing loan to buyer to go with it! Though this was an exceptional case, it disproved the notion that the bank always try to lend as low as possible based on the value of the house. In fact, recent examples seem to suggest willingness of the banks to lend, depending on the credit-worthiness of the borrower.)

(Ah, this reminds me of when my wife first bought the house for rebuilding. It was a run-down wooden house, but the bank manager was so eager to sort out the outstanding loan (non-performing, I guess) that he offered a decent housing loan to buyer to go with it! Though this was an exceptional case, it disproved the notion that the bank always try to lend as low as possible based on the value of the house. In fact, recent examples seem to suggest willingness of the banks to lend, depending on the credit-worthiness of the borrower.)

(Ah, this reminds me of when my wife first bought the house for rebuilding. It was a run-down wooden house, but the bank manager was so eager to sort out the outstanding loan (non-performing, I guess) that he offered a decent housing loan to buyer to go with it! Though this was an exceptional case, it disproved the notion that the bank always try to lend as low as possible based on the value of the house. In fact, recent examples seem to suggest willingness of the banks to lend, depending on the credit-worthiness of the borrower.)

(Ah, this reminds me of when my wife first bought the house for rebuilding. It was a run-down wooden house, but the bank manager was so eager to sort out the outstanding loan (non-performing, I guess) that he offered a decent housing loan to buyer to go with it! Though this was an exceptional case, it disproved the notion that the bank always try to lend as low as possible based on the value of the house. In fact, recent examples seem to suggest willingness of the banks to lend, depending on the credit-worthiness of the borrower.)Your appraiser...

(here again, there are a few varying examples like whether the appraiser is acting for the buyer or banker, and the perceived 'nudge nudge wink wink' type of arrangement. Valuation is so subjective that different valuers will have different valuation figures, though they would try their best to base them on most recent transactions of similar type of property in the same locality. Here again, I cannot help thinking of cases of over- or under- statement of price for different reasons like tax or stamping fee.)

(here again, there are a few varying examples like whether the appraiser is acting for the buyer or banker, and the perceived 'nudge nudge wink wink' type of arrangement. Valuation is so subjective that different valuers will have different valuation figures, though they would try their best to base them on most recent transactions of similar type of property in the same locality. Here again, I cannot help thinking of cases of over- or under- statement of price for different reasons like tax or stamping fee.)

(and political opponents? Anyway, I believe there are certain acceptable reasons which could help reduce the value for rating purposes, after valuation is done by the council appraiser. In many cases, house owners added extensions without approval and escape enforcement as well as increased assessment.) (here again, there are a few varying examples like whether the appraiser is acting for the buyer or banker, and the perceived 'nudge nudge wink wink' type of arrangement. Valuation is so subjective that different valuers will have different valuation figures, though they would try their best to base them on most recent transactions of similar type of property in the same locality. Here again, I cannot help thinking of cases of over- or under- statement of price for different reasons like tax or stamping fee.)

(here again, there are a few varying examples like whether the appraiser is acting for the buyer or banker, and the perceived 'nudge nudge wink wink' type of arrangement. Valuation is so subjective that different valuers will have different valuation figures, though they would try their best to base them on most recent transactions of similar type of property in the same locality. Here again, I cannot help thinking of cases of over- or under- statement of price for different reasons like tax or stamping fee.)

No comments:

Post a Comment